To add a labor type to the Costbook follow these steps:

1. Click on Costbook.

2. Click on Labor Types.

3. Click the New Labor Type button to open the input screen.

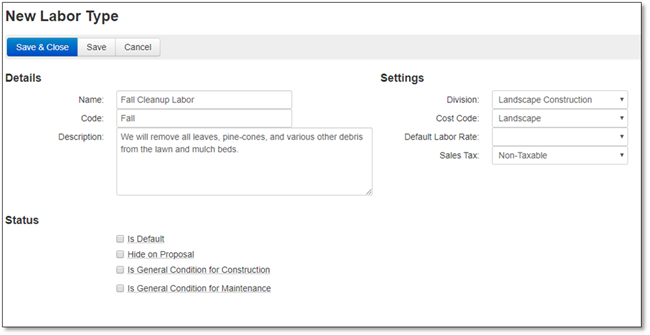

4. Once the Labor Type input screen appears you can enter the following:

Details section: Enter the Name, Code and Description (optional).

Settings Section:

Choosing the Division will set the corresponding Purchasing Tax & Sales Tax, but you can choose to change the tax.

You can choose a Cost Code which is used for tracking job costs on your Timesheet/Job Log, if you have the Job Management Module.

You can choose a Default Crew Type; this will be used in Timesheet if you have the Job Management Module.

Status Section:

You can choose to Hide on Proposal if you do not want to see this item on your proposal.

If the equipment is rented check the Equipment is rented checkbox, which will allow you to select a Supplier and specify a Purchasing Tax.

You can choose to set this as a General Condition, which enables this cost to then be spread across the estimate automatically, so they are evenly distributed across your different work areas.

Default Billing Section: The way the way that the item will be billed to the customer. Future modules will have different billing options.

5. Click the Save button to save the Labor Type to the Costbook or Cancel if you would like to discard the entry.